The COVID-19 pandemic has increased policymakers’ demand for more timely insights into the economy. Household consumption is a key component of the economy so improving the timeliness and coverage of indicators of household spending is important. The ABS has been exploring the use of aggregated, de-identified transactions data from participating banks as a source for a new monthly indicator of household spending (‘the indicator’), which captures spending at the point of expenditure. This differs from household consumption, which is the point at which the household incurs a liability to the seller.

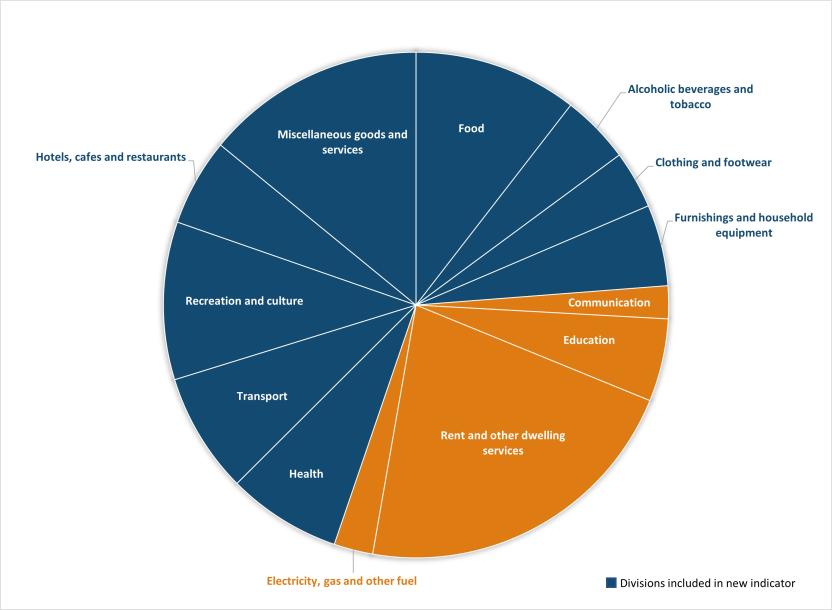

This indicator provides early insights into household spending well before the Quarterly National Accounts. In household consumption terms, the indicator represents more than twice the coverage (68 per cent) of the current monthly Retail Trade survey (30 per cent). Household consumption is approximately 50 per cent of Gross Domestic Product (GDP).

The indicator will be published eight weeks after each month and data for all state and territories as well as at the national level will be available. Over time, we expect to shorten this publication lag when more robust processing systems are developed.

Producing this new indicator has been made possible because of the ongoing goodwill of several of Australia’s banks. It also expands the suite of the ABS monthly products following the release of the business turnover series using Business Activity Statement data from the Australian Taxation Office.

The ABS will continue to explore the opportunities high frequency datasets provide to produce timelier insights into how Australia’s economy is performing.

Improving the timeliness and frequency of economic statistics while maintaining their quality is a longstanding challenge in the production of official statistics. This paper outlines the development of the indicator focusing on:

- testing the suitability of bank transactions data as the primary data source;

- the alignment with other comparable concepts such as the national accounts concept of household final consumption expenditure; and

- the quality of the estimates produced.